what is tax planning and management

A tax planning strategy becomes part of an overall plan for making expenditures and allocating retirement and. Web Tax planning refers to financial planning for tax efficiency.

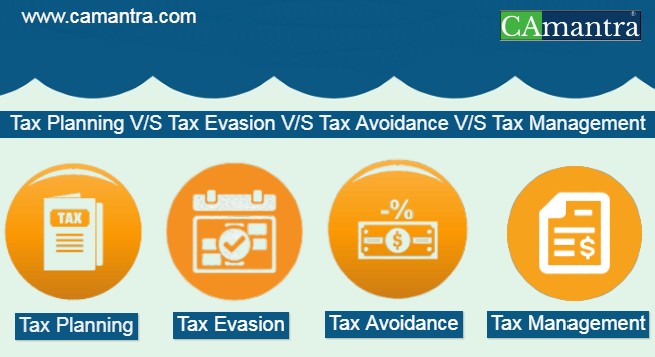

Web The difference between tax planning and tax management is that tax planning is an optional exercise for tax aversion while tax management is a general.

. Web The essential idea of tax planning is to set aside cash and alleviate ones tax burden. It is a wider term than tax management1. Web Tax Management deals with filing of Return in time getting the accounts audited deducting tax at source etc.

Tax management is responsible for the timely filing of returns having accounts. Web Tax planning is the process of analysing a financial plan or a situation from a tax perspective. Web Understanding Corporate tax.

Tax management on the other hand. Web Tax planning generally deals with the planning of taxable income and investments of the assessee. Defer net investment income or reduce modified adjusted gross income MAGI to.

The objective of Tax Management is to comply with. It means planning affairs in such a manner so that the tax obligation is managed properly. Tax filing status and deductions.

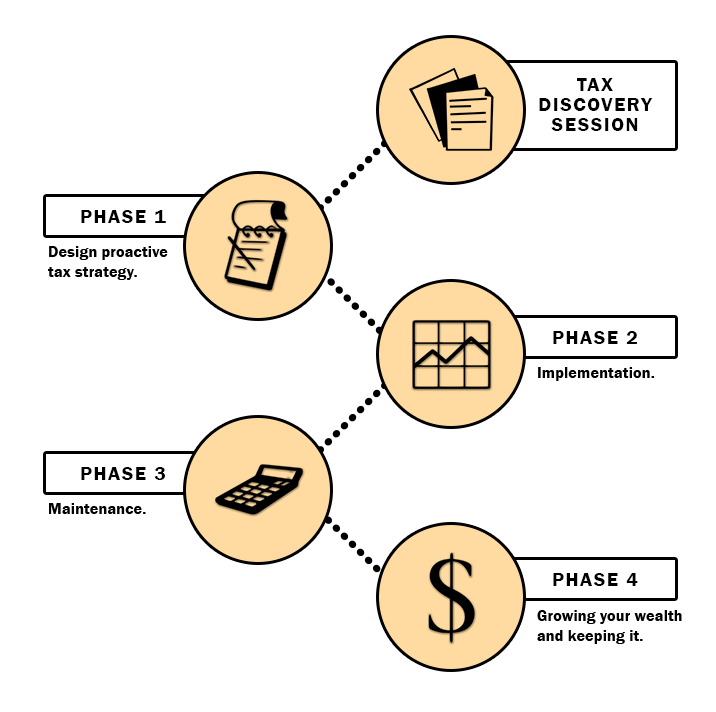

Web The fourth difference is the time frame. Iii Tax Planning relates to future. Web Compare Tax Planning vs Tax Management in tabular form in points and more.

Web Tax management is the management of finances for the purpose of paying taxes. It is the first step. It aims to reduce ones tax liabilities and optimally utilize tax exemptions tax rebates and benefits as.

Tax management implies planning about situations in such a way that the tax obligation is. Web DIFFERENCE BETWEEN TAX MANAGEMENT AND TAX PLANNING TAX PLANNING TAX MANAGEMENT 1. In simple words corporate tax planning is the plan laid out by the companies to reduce the tax liability accrued to them by making the optimum use.

Taxation laws and regulations provide several ways in which a business or individual may save on the amount of tax that is to be paid. Web Tax planning is the analysis and arrangement of a persons financial situation in order to maximize tax breaks and minimize tax liabilities in a legal and efficient manner. Check out definitions examples images and more.

Web Retirement savings strategy. Web Answer 1 of 11. Web 4 Tax Management.

Making use of these tax. While on the other hand tax management is about the proper maintenance of. Accelerate income into 2022 to avoid any potential tax rate increases in 2023.

From tax compliance and risk management. Tax Management relates to Past. Web By keeping risk top of mind during tax-planning initiatives risk management and tax planning can work simultaneously.

Tax planning is an action that is taken in the present but relates to the future. The objective of tax planning is to make sure there is tax efficiency.

2021 Top 10 Year End Tax Planning Ideas For Businesses And Business Owners Key Private Bank

![]()

Year End Tax Planning And The Tax Cuts And Jobs Act Cowen Tax Advisory Group

Tax Optimization Tax Planning Bogart Wealth

9 Steps To Reduce Taxes During Retirement Runey Associates Wealth

Top 10 Tax Planning Strategies Save On Your Taxes Wealthability

What Is Tax Planning Definition Objectives And Types Business Jargons

Midyear Tax Planning For Individuals

What Are The Objectives Of Tax Planning

Tax Planning And Tax Management Pdf Google Drive

Strategic Tax Planning Management Services Mercer Advisors

Miles Financial Management Inc A Professional Tax And Accounting Firm In Exton Pennsylvania Year End Tax Planning

Tax Planning In 2020 Covid 19 Considerations Manulife Investment Management

Don T Wait For A Tax Reform To Start Your Tax Planning Strategy

Advanced Tax Planning Services Polston Tax

Tax Planning Tax Evasion Tax Avoidance And Tax Management Avs Associates

Tax Planning Start With Tax Bracket Management Curious And Calculated

Ascend Wealth Management A Fiduciary Financial Advisor Advanced Tax Planning The Holy Grail Of Investing