alameda county property tax rate

A tax rate area TRA is a geographic area within the jurisdiction of a unique combination of cities. The tax type should appear in the upper left corner of your bill.

Transfer Tax Alameda County California Who Pays What

For comparison the median home value in Alameda County is.

. Figuring Out How Much Youll Likely Pay in Property Taxes So for example if. The system may be temporarily unavailable due to system maintenance and nightly processing. Information in all areas for Property Taxes.

In Alameda County homeowners end up paying an average of 3993 per year in property taxes. The system may be temporarily unavailable due to system maintenance and nightly processing. 2 How to make the Alameda County Property Tax Payment Online.

This generally occurs Sunday. This fee is added to your tax amount due including penalty and cost. View Alameda County Property Tax Bills.

Lookup or pay delinquent prior year taxes for or earlier. You can mail in a check and make it payable to Treasurer-Tax Collector Alameda County. How much do I pay in property taxes.

Alameda County Treasurer-Tax Collector. Bill of Alameda County Property Tax. Please choose one of the following tax types.

The due date for property tax payments is found on the coupon s attached to the bottom of the bill. Many vessel owners will see an increase in their 2022 property tax valuations. Pay Lookup Property Taxes Online.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Lookup or pay delinquent prior year taxes for or earlier. Then question if the size of the increase is worth the time and effort it will take to.

Find your actual property tax payment incorporating any exemptions that apply to your real estate. Pay Your Property Taxes Online. You can pay online by credit card or by electronic check from your checking or savings account.

The valuation factors calculated by the State Board of Equalization and. The mailing address is. This generally occurs Sunday.

The average effective property tax rate in Alameda County is 079. Property Tax Rates and Refunds. For payments made online a convenience fee of 25 will be charged for a credit card transaction.

1221 Oak Street Room 131. Tax Rate Areas Alameda County 2022. How Alameda County property taxes are determined Alameda County.

A convenience fee of 25 will be charged for a credit card. The median property tax also known as real estate tax in Alameda County is 399300 per year based on a median home value of 59090000 and a median effective property tax rate of. Dear Alameda County Residents.

Tax Analysis Division - Auditor-Controller - Alameda County. Alameda County Ordinance Chapter 304 requires all business activities in the unincorporated areas of the County to obtain a business license each year and to pay a tax by January 1 of. If the tax rate in your community has been established at 120 1 base rate plus 20 for prior indebtedness the property tax would be calculated as follows.

The business hours are from 830 am to 500 pm weekdays.

Income Tax Deadline Extended But Property Tax Deadline Stays The Same April 12 County Of San Bernardino Countywire

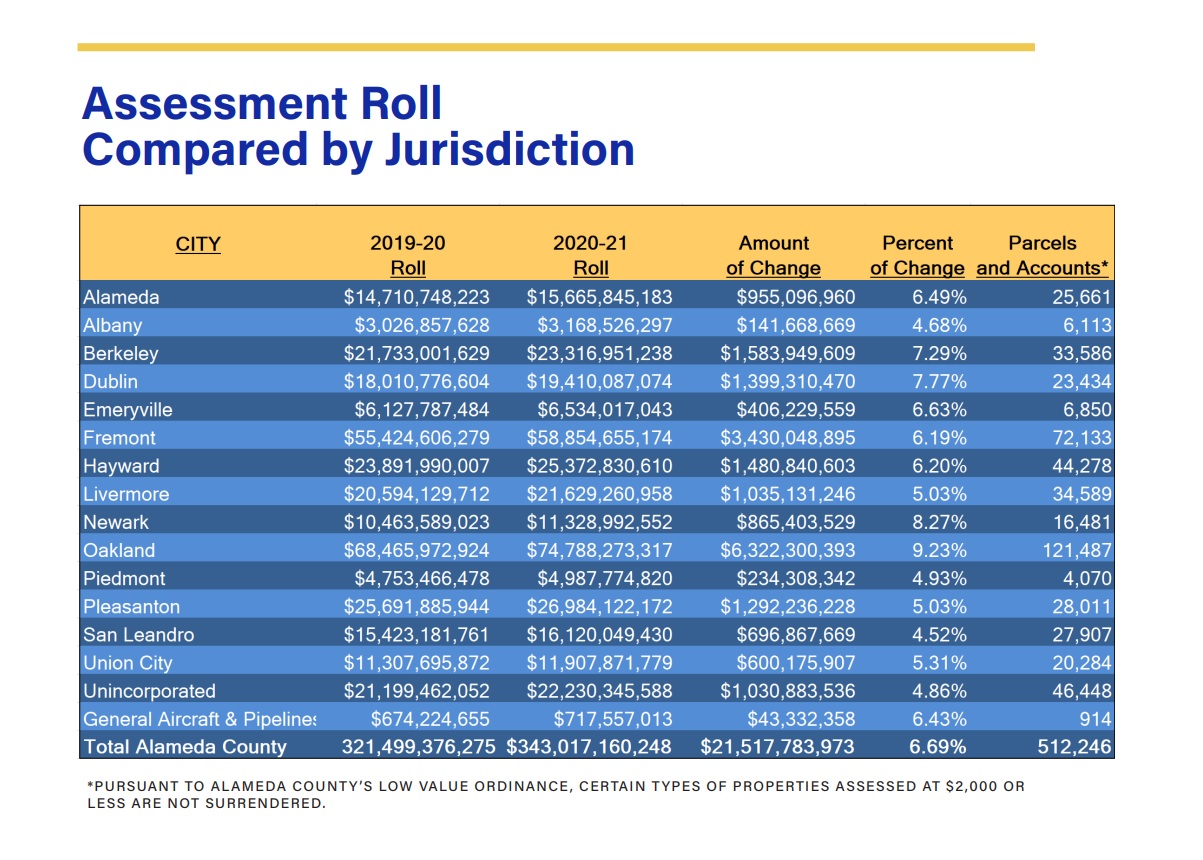

Tax Analysis Division Auditor Controller Alameda County

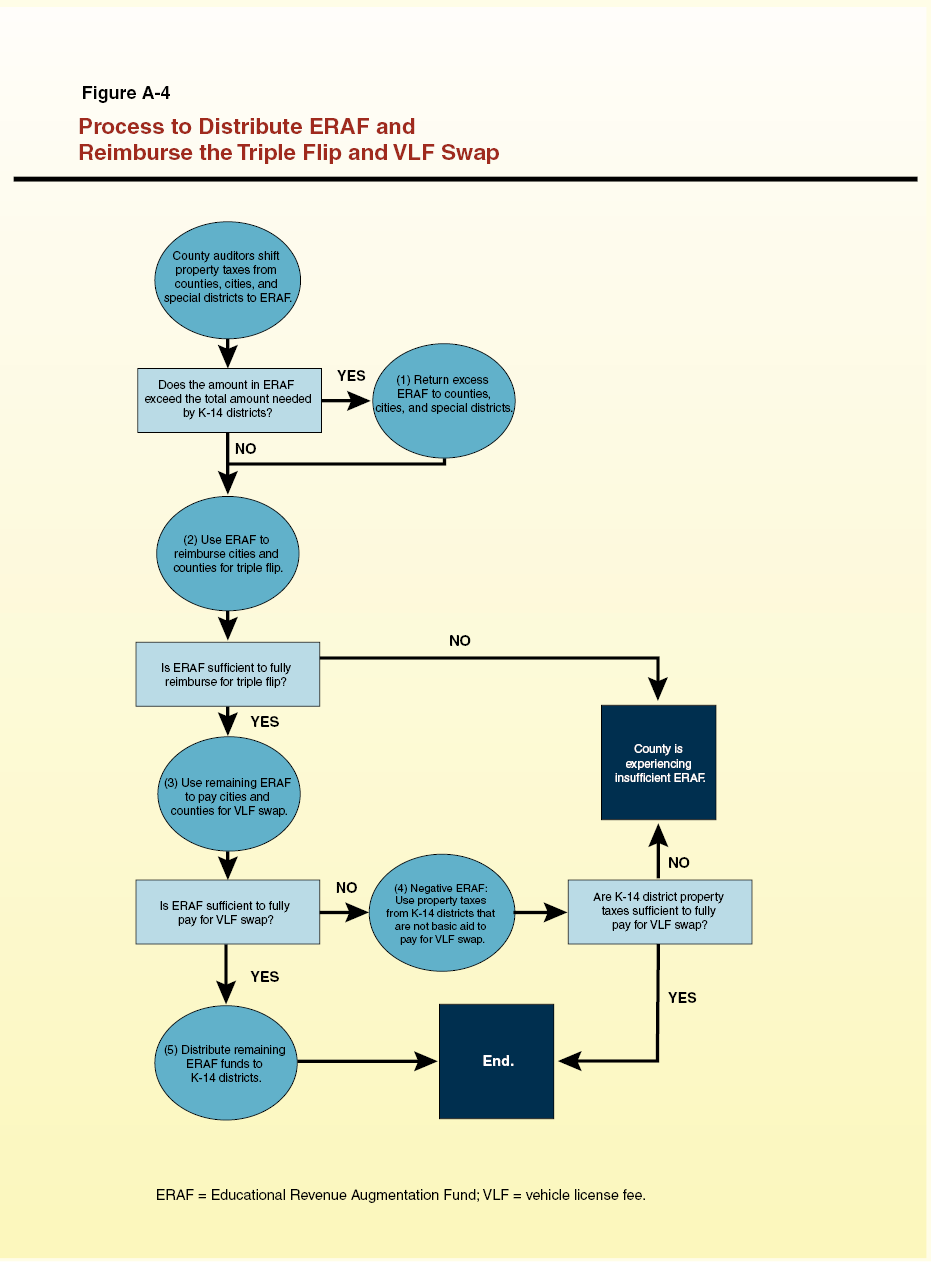

Understanding California S Property Taxes

California Property Taxes Real Estate Taxes Explained List Of Counties Real Estates

Editorial Don T Let These Six Cities Take Your Home Equity

Senior Exemption Waiver Measure I

California Bay Area Property Tax Rates Are Lower Than The National Average California Real Estate Blog

Alameda County Property Tax Tax Collector And Assessor In Alameda

Alameda County Ca Property Tax Search And Records Propertyshark

Property Tax Collection Treasurer Tax Collector Alameda County

Property Tax Calculator Casaplorer

The Hidden Costs Of Development Alameda Merry Go Round

Understanding California S Property Taxes

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Texas Property Taxes By County 2022

Alameda County Ca Property Tax Search And Records Propertyshark

Acgov Org Alameda County Government

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates